Marketing to Dentists: How to Market to Dentists

Marketing to healthcare providers (HCPs) is no easy feat. HCPs—including dentists—make up a niche market without a ton of time on their hands to research the new product you’re marketing. The competition to earn their attention is fierce, so the more specific you can get with your targeting and messaging, the better.

When marketing to dentists, you have to go beyond traditional demographic data and dig a bit deeper into dentist-specific segmentation and targeting. Here are our top tips on how to market to dentists.

Want more details on everything it takes to market to HCPs (including dentists)?

Sign up to receive our upcoming eBook

How to Market to Dentists Using Precise Targeting Methods

Start with an Understanding of the Dental Market

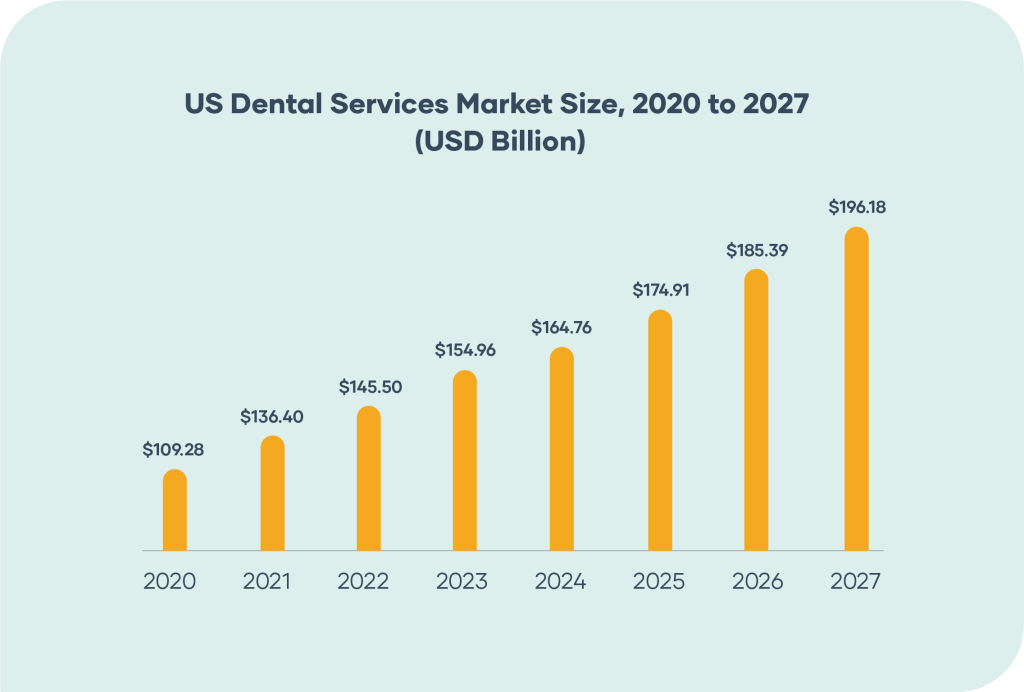

Market Size and Growth

The dental market has been increasing steadily for the past few years and is expected to continue on an upward trend to $196.18 billion by 2027 with a CAGR of 6.24%. This growth is due to the US’s aging population and the ongoing demand for preventative and restorative dental care. However, this trend could slow, as younger generations have benefited from water fluoridation, more preventative dental education, and improved insurance coverage, suggesting the number of appointments per person could decrease in the future along with increases in efficiencies.

(Source: Precedence Research, 2021)

The US dental market is expected to increase at a CAGR of 6.24% to reach $196.18 billion by 2027.

Total Addressable Market

To set realistic goals and determine campaign success, you have to understand the total addressable market. When it comes to marketing to dentists and other specialty HCPs, you have to remember just how tiny the community is. Add in geographic constraints or subspecialty layers and your total addressable market shrinks significantly.

According to the American Dental Association, there are 202,536 active dentists in the US as of 2022.

Next, Look into Traditional Demographic Information

I know we said that you have to go beyond traditional demographic data to successfully market to dentists—but that doesn’t mean you shouldn’t use that information at all. Niche targeting starts with the general and then goes to the specific. Although these details tend to be less important when targeting dentists, they can be useful in making inferences about your audience and can be used to tighten segments for smaller marketing budgets. And, of course, dentists aren’t just doctors—they’re people too. So, it’s helpful to think about their circumstances and demographic distribution.

Age

Within the total addressable market is a select group of individuals who are the decision-makers with the power to purchase your product. When marketing to dentists, it’s important to consider who these decision-makers are and what their role within the practice is. Using age can be an initial strategy for slimming down your target audience to key decision-makers.

Dentist Age Breakdown |

||

| Age | Number of Dentists | % of Workforce |

| Under 35 | 35,849 | 17.7% |

| 35-44 | 50,837 | 25.1% |

| 45-54 | 44,558 | 22.0% |

| 55-64 | 39,291 | 19.4% |

| 65 and up | 32,001 | 15.8% |

According to the American Dental Association, the average age of retirement was 68.2 in 2020 and decreased to 67.9 in 2021. Depending on your product, these ages could be used as reference points for dentists who are looking to sell or make other strategic decisions in their practices.

For example, if you’re marketing appointment scheduling software to dentists, you’re likely going to be targeting practice owners. Unfortunately, “dental practice owner” is not a standard audience targeting criteria in most marketing platforms. Therefore, to reach this small group, you’ll need to start with targeting “dentist,” “DDS,” or “DMD” and then layer on additional specifics to make sure you’re targeting your ideal prospects.

Age matters because you can make some general inferences about how old someone needs to be before they can reasonably own a practice. It takes about 8 to 10 years to become a dentist, including 4 years for a bachelor’s degree, 4 years of dental school, and another 2 years of school for specialty training. Many students who go straight through their education after high school graduate around the age of 26 (or 28-29 if they do additional specialized training). Most will work for a few years before even considering opening a private practice, so it’s fair to assume you can limit your target audience to 32 and above.

Location

Location won’t be a huge factor in a traditional plan for marketing to dentists unless you have some specific limitations or goals. Typically, limiting to a geographic region creates an audience that is too small for most advertising platforms. However, depending on your product you can use this information to support campaigns based on:

- CME deadlines or other licensing requirements

- Enrollment dates for programs

- Prevalence of Medicare, Medicaid, or other specific private payers

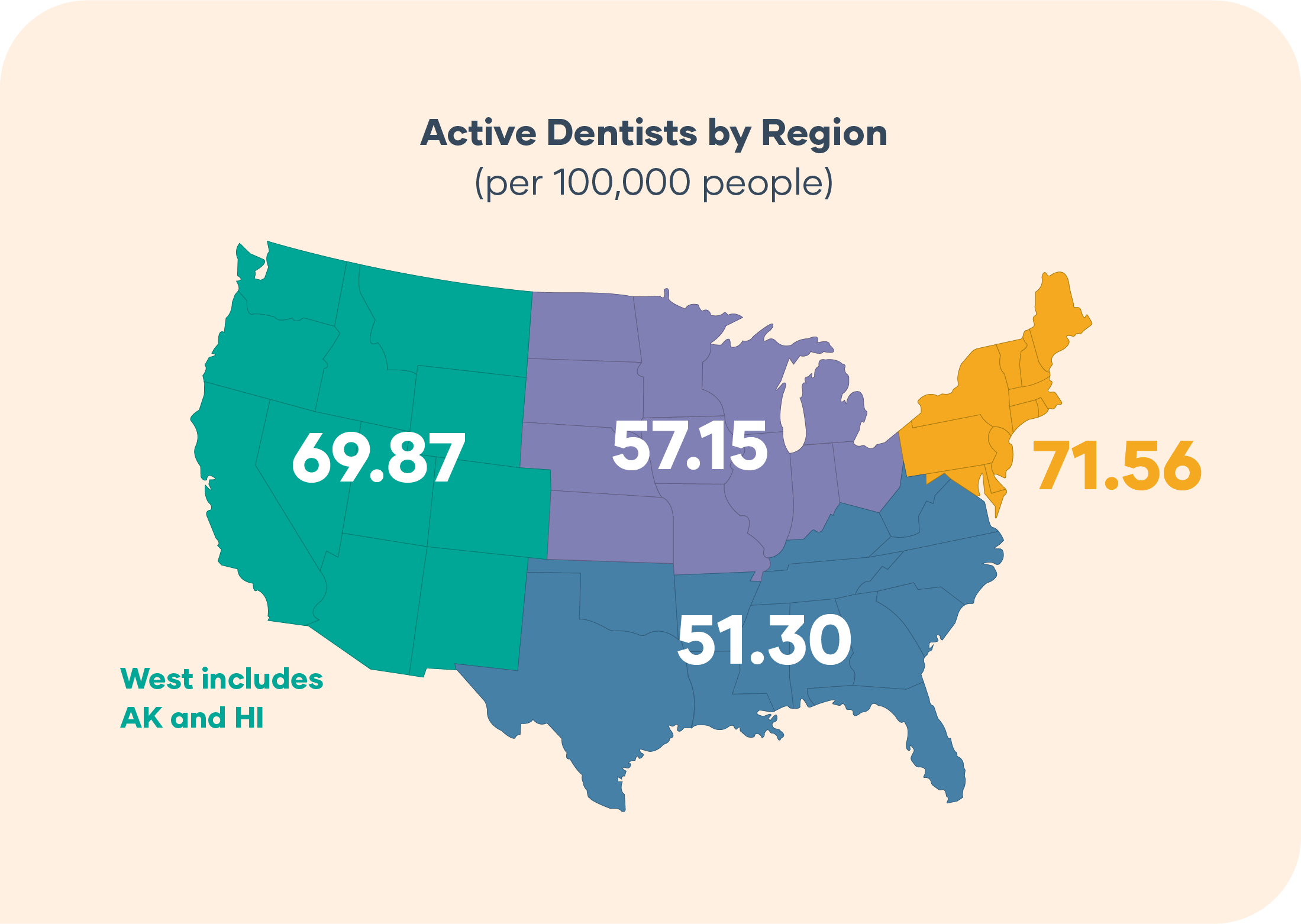

The density of active dentists across the US is about 61 per 100,000.

Although California has the most dentists in the US at 25.2k, the West is still behind in terms of density compared to the Northeast. In particular, Massachusetts has the most dentists per capita at 83.38 per 100,000 people despite not even being in the top 5 states with the highest number of active dentists.

(Data Sources: National Center for Biotechnology Information, Kaiser Family Foundation)

Gender

When marketing to dentists, gender is probably the least used piece of classic demographic information. However, it is one of the most commonly used tactics in traditional marketing and advertising. While we don’t recommend targeting based on these criteria (unless you have a specific reason or campaign), more traditional teams may still want to know this information.

Dental Gender Breakdown |

||

| Gender | Number of ENTs | % of Workforce |

| Male | 125,989 | 62.2% |

| Female | 74,317 | 36.7% |

| Unspecified | 2,230 | 1.1% |

| Total | 202,536 | 100% |

While it’s clear that male dentists are more prominent in the industry, things are beginning to even out with parity expected to be reached in 2040. In June 2021, women saw that highest rate of dental school enrollment ever at 56%. Based on trends associated with female dentists, the ADA also predicts other dental practice trends will continue to accelerate such practice consolidation and a shift away from practice ownership.

Then, Consider Their Life Circumstances

Outside of traditional demographics, it’s important to understand how dentists behave—not just as doctors, but as humans too. Their personal circumstances can provide you with some insights into how they will behave and what their top concerns within their practice might be.

Happiness

There have been few studies on the state of job satisfaction and happiness among dentists worldwide. One study found that 76.6% of dentists were satisfied with their jobs at a moderate to high level, with specialists generally being more satisfied than generalists. While another found that various life factors (including things like work settings, income, marital status, etc.) were associated with overall happiness, satisfaction with life, and affect balance.

Factors associated with the highest job satisfaction:

- Patient relationships

- Respect

- Delivery of care

- Staff

- Professional relationships

- Professional environment

Factors associated with the lowest job satisfaction:

- Personal time

- Stress

- Income

- Practice management

- Professional time

Dentistry is consistently found to be a satisfying career, and specialists tend to be even more satisfied with their careers.

Burnout

While COVID was clearly a huge contributing factor, anxiety and burnout have been a prevalent problem in the industry for years. The American Dental Association 2021 Dentist Health and Well-Being Survey reported that 16% of dentists were diagnosed with anxiety—a greater than 3-fold increase since the last survey in 2003. The survey also found that younger dentists are disproportionally impacted by mental and emotional health concerns, while dentists over the age of 40 are more likely to be affected by physical health concerns.

1 in 10 dentists experience burnout, which includes emotional exhaustion, depersonalization, and reduced personal accomplishment.

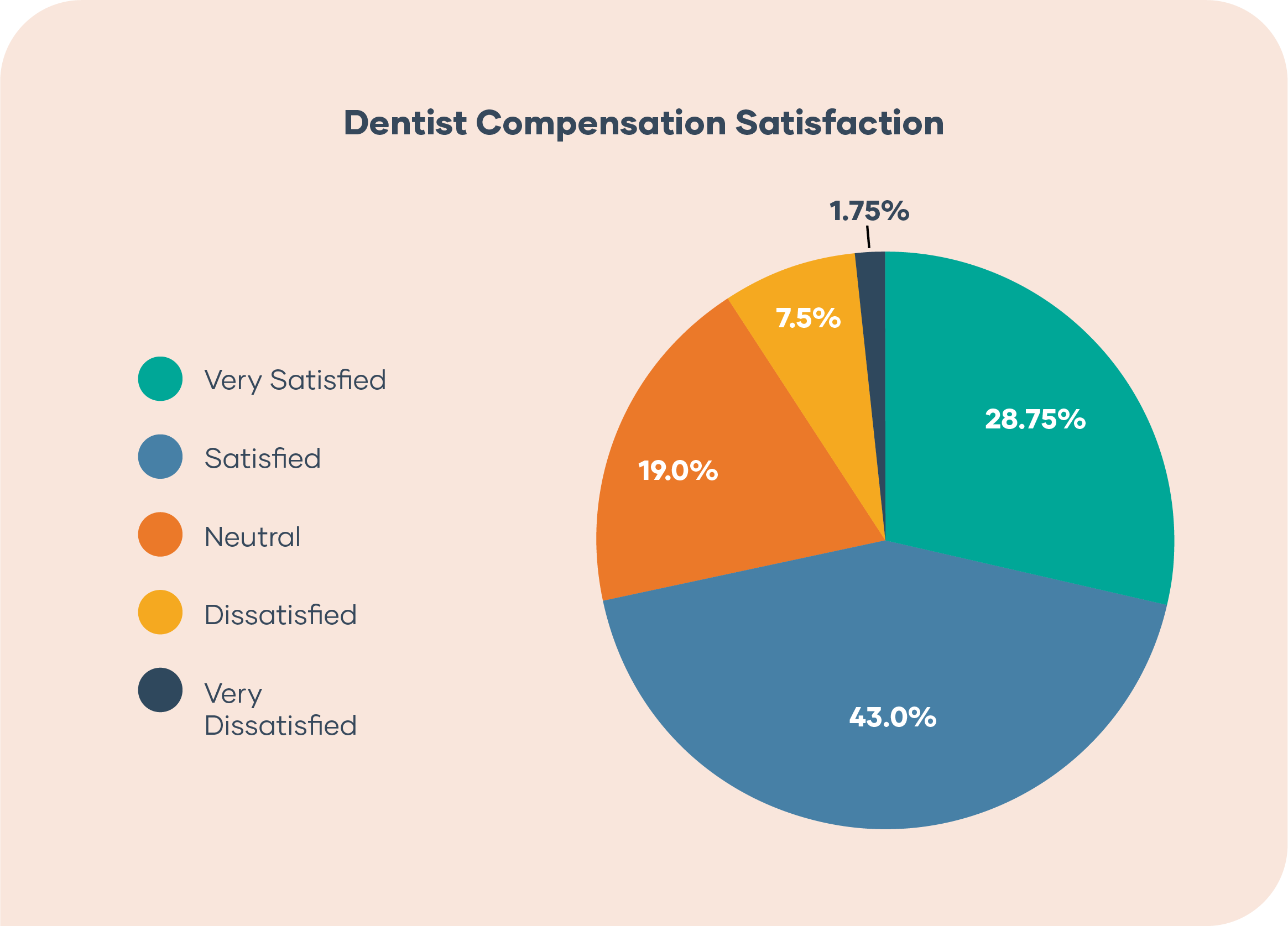

Salary and Job Satisfaction

The national average dentist salary in 2022 was $289,550 for dental owners and partners working in private practices while dentists employed by someone else made an average of $195,800. However, average salary differs largely by region, with the Northeast significantly bringing up that average.

Dental Regional Compensation Breakdown |

|||||

| – | Northeast | South | Midwest | West | National |

| Owners/ Partners | $316,340 | $289,600 | $287,000 | $265,250 | $289,550 |

| Associates / Employees | $218,800 | $174,200 | $196,140 | $194,090 | $195,800 |

In 2022, dental practice owners and partners made an average of $289,550, and associate/employee dentists made an average of $195,800.

Compared to previous years, owners and partners are making slightly less (2.25% decrease or -$6,620), while employees are demanding (and getting) slightly more (1% increase or +$1,290).

Now, when it comes to dentistry, there is a lot to consider that goes into those numbers, such as:

- How dentists are paid (salary, percent of collections, percent of production, etc.)

- Private practice vs. DSO employment (more on this below)

- Years of experience

- Specialty procedures (particularly implants)

Ultimately, 72% of dentists are “satisfied” or “very satisfied” with their compensation. Those who indicated they were satisfied earned an average income of $392,340. On the flip side, 9.25% of dentists indicated that they were dissatisfied with their income. Those in that group averaged $174,300, and half of the dissatisfied dentists made less than $150,000 per year.

(Source: Dental Post, 2023)

Even with these overall increases in compensation and general satisfaction, 30% of the dental workforce is considering a job change. The main reasons cited for changing jobs are higher pay, positive work culture, and appreciation from their employer.

Hyper-Specific Targeting Criteria for Improved Marketing to Dentists

Traditional demographic targeting can be used as a starting point for marketing to dentists; however, layering those general targets with additional niche specifications is the key to running a successful campaign. It’s these nuanced details and insights that will help you target the right dental prospects without wasting precious marketing or advertising budget.

Practice Settings

Practice setting is one of the most importance slices within dentistry. With so many practices joining dental service organizations (DSOs) you need to know who is in charge of making decisions. Beyond that, it’s important to consider how this impacts their day-to-day. Do they run a small office where they have hired each person that works there? Or are they part of a larger machine?

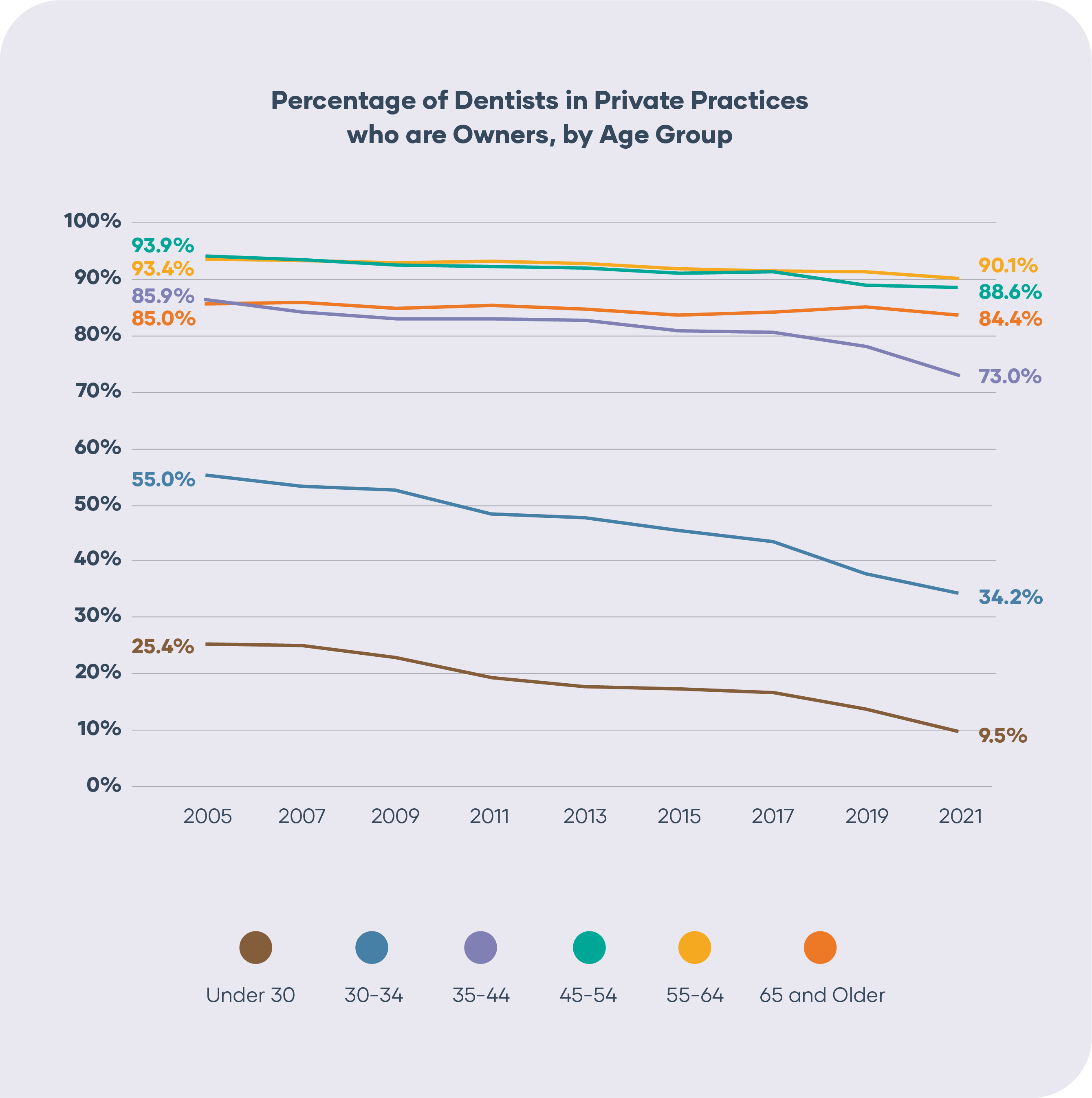

Dental practice ownership has declined from 84.7% in 2005 to 73% in 2021. This trend is particularly apparent among younger dentists who are choosing to be employed (and stay employed) by DSOs.

(Source: American Dental Association, 2021)

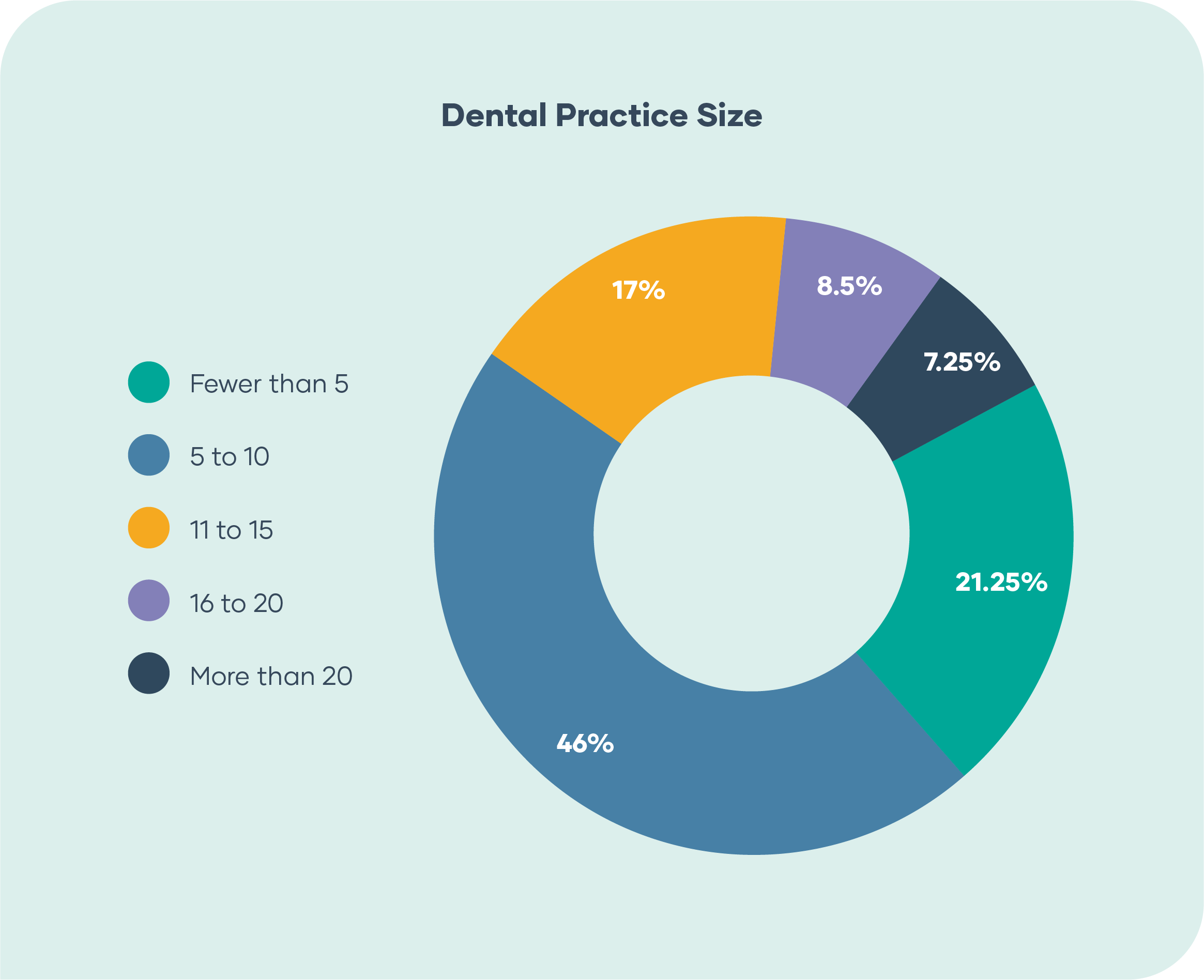

Nearly half of dentists work in a practice with 5 to 10 team members, and nearly 33% work with a team of 10 or more. Practice size continues to be consistent year over year with similar size breakdowns between private and corporate practices. If you can get the data, targeting based on practice size is a great way to make sure you’re targeting the right prospects who can authorize decisions or funds, or take a more strategic approach around creating content for outside influencers.

(Source: Dental Post, 2023)

Over two-thirds of dentists work in a practice with 10 team members or fewer.

Dental Service/Support Organizations (DSOs)

Our marketing strategy typically works best when marketing directly to practice owners and key decision-makers. However, we can’t talk about dental trends without considering DSOs and the impact they are having on the industry. If you are looking to target DSOs, we recommend taking more of an enterprise-ABM approach.

What Is a DSO?

DSOs are large companies that acquire a dental practice and take over the office operations and administrative work. They basically act as the “office” portion of a dental practice and often handle marketing, insurance/billing, etc. For dentists early in their career, DSOs offer stable salaries without the need to invest in their own private practices on top of large sums of student loan debt. In contrast, dentists later in their career can benefit from fighting against the labor shortage in staffing their own offices.

- Don’t have to worry about administrative or other office tasks (recruiting, legal support, etc.)

- Dentists later in their careers find that there is less financial risk switching to a DSO model vs selling their practice

- DSOs can offer better salary and benefits packages

- Increased access to cutting-edge technology and continuing education

- Practice location flexibility

- Less autonomy and control over your practice

- Predetermined and negotiated insurance plans

- Limited or no control over scheduling and time off

- Additional restrictions based on contractual agreements

Largest DSOs in the US

The 5 largest DSOs in the US include:

- Heartland Dental: 1,700+ locations across 38 states

- TAG – The Aspen Group: 1,100 locations across 45 states

- Pacific Dental Services: Nearly 1,000 locations across 25 states

- Smile Brands: Nearly 700 locations across 30 states

- Sonrava Health: 560 offices across 20 states

DSO Fast Facts

- As of 2017, there were over 350 DSOs in the United States

- Approximately 18-20% of dental practices are affiliated with DSOs, and that number is expected to grow to 50-65% by 2025

- Among dentists in the first 10 years of their careers, 23% are affiliated with a DSO

Payment

Insurance

More and more dentists are choosing to implement other types of payment models outside of the traditional insurance model.

1 in 6 dentists have chosen to drop out of some insurance networks, shrinking their patient base by an average of 17.5%.

Many dentists are choosing a fee-for-service model, essentially operating as an out-of-network practice. The practice will accept insurance and charge the full fee for the procedures (which is different than an in-network practice where the negotiated provider fee schedule comes into play). In some cases, dentists find they can make more money charging patients directly for services (some offering payment plans or discounts for up-front cash payments). Others offer in-office dental plans where patients pay a fixed amount monthly or annually in exchange for preventative services at no charge and other services at a discounted rate.

Public Programs

Nearly 75 million adults and children receive dental coverage through Medicaid. But it’s important to note that enrolling as a Medicaid provider does not equate to treating Medicaid patients. For example, in Michigan, over 20% of the dentists enrolled as Medicaid providers treat 0 Medicaid patients, leaving a smaller subset of dentists to take care of this patient population. Understanding the participation breakdown (and how this impacts your specific product) is an important research step in developing your marketing to dentists strategy.

Only 1 in 3 dentists in the US treats Medicaid patients.

Skills and Subspecialties

Dentistry has a number of specialties that can be layered onto degree targeting of DDS (doctor of dental surgery) and DMD (Doctor of Medicine in Dentistry or Doctor of Dental Medicine). Taking this layered approach can help you reach an even smaller group of prospects by specialty:

- Dental Anesthesiology (DA)

- Dental Public Health

- Endodontics

- Oral and Maxillofacial Pathology

- Oral and Maxillofacial Radiology

- Oral and Maxillofacial Surgery

- Oral Medicine

- Orofacial Pain (OFP)

- Orthodontics and Dentofacial Orthopedics

- Periodontics

- Pediatric Dentistry

- Prosthodontics

Beyond the DMDs

Doctors are not the only people making recommendations within a practice, whether that’s for patient care or solutions that help things run more smoothly. So, you should be sure to create materials that appeal to the other key people that commonly work within dental practices:

- Certified Dental Assistant (CDA)

- Registered Dental Hygienist (RDH)

- Certified Dental Technician (CDT)

- Office Managers

These key team members spend a considerable amount of time keeping things running whether they work with patients directly or just have the ear of the practice owner. All of these influencers are often easier to reach than the docs—so don’t forget to include them in your plan for marketing to dentists.

Look-alike Audiences and Hashtags

Look-alike audiences and hashtags can be helpful when identifying audiences on social media. Specific audiences and hashtags can be used to weed out consumers and make it easier to target the dentists you care about. However, when targeting dentists and other healthcare specialties, it’s important to take a critical look at who follows the accounts/hashtags as well as the types of content they are promoting and associated with.

For example, there are a variety of associations for DDSs and DMDs to join, but many of these organizations’ social media accounts post patient-related content such as tips on foods to avoid for whiter teeth or PSAs on how often they should be visiting the dentist. You should evaluate each account before adding it to your targeting, but we recommend building a target audience using the following types of accounts:

- National and regional associations

- Medical school alumni associations

- Conferences

- Specialty journals and publications

When it comes to hashtags, it’s important to leverage medical language, professional conferences, and professional organizations to avoid targeting patients. Some good hashtags for dentists include:

- #DentEdJobs

- #IamADEA

- #AACDfam

- #ADASmileCon

Feel a Little Overwhelmed?

Let Us Help You Develop Your Marketing to Dentists Plan

Marketing to dentists is not easy. It takes expert knowledge, a nuanced strategy, and a layered approach in order to make traditional marketing platforms home in on an audience they were not designed to target. We know there’s a lot to consider (we just wrote this nearly 3,000-word post on the matter), which is why we recommend partnering with an expert, like us, who knows exactly how to market to dentists.

At glassCanopy, we provide start-to-finish content and lead generation for organizations looking to market their products or solutions to dentists. We handle everything from strategy and content creation to campaign deployment and optimization.

Want to learn more about what we can do for you?

Let’s Talk- Medical Marketing SEO: Using SEO to Target Doctors and Healthcare Professionals (+ Checklist) - December 4, 2023

- Marketing to Dentists: How to Market to Dentists - August 8, 2023

- HCP Marketing Trends 2023: 23 HCP Marketing Stats for 2023 - November 30, 2022