ENT Advertising: Digital Marketing to Otolaryngologists & Otorhinolaryngologists (ENTs)

Marketing to healthcare providers (HCPs) is always a challenge. Competition is fierce and big pharma companies in particular have astronomical budgets.

In the case of marketing to ENTs, it’s even more challenging. There’s less than 10,000 ENTs in the US. And more than 330 million other people who aren’t ENTs. So you really have to dig into otolaryngology-specific targeting and messaging to make your ENT advertising impactful and not wasted across the wrong specialists or consumers.

Here’s how we do it.

Want more details on everything it takes to market to HCPs (including ENTs and otolaryngologists)?

Sign up to receive our upcoming eBook

Understanding the ENT Advertising Market

To understand market penetration and potential, it’s important to understand the size and scope of the ENT market as a whole.

Market Size and Growth

The ENT market is experiencing continued growth, especially as increasing air and noise pollution are driving an increase in ENT-related diagnoses across all age groups.

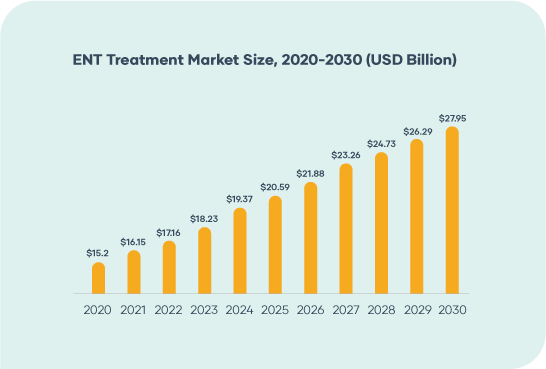

Global ENT market revenue was estimated at $16.5 billion in 2021 and is expected to reach $27.95 billion by 2030, with a CAGR of 6.3% from 2022 to 2030.

(Source: Precedence Research, 2022)

The global ENT device market, which includes things like diagnostic/surgical devices, hearing implants, hearing aids, and nasal splits, is currently valued at $23 billion in 2022, with a similar anticipated CAGR of 5.74% from 2023 to 2030.

In addition to general air and noise pollution, here are some additional factors impacting ENT supply and demand:

-

- Aging and growing population

- Increased penetration of minimally invasive ENT procedures

- Significant advancements in AI and ML for ENT devices

- Projected primary care shortages

The largest factors impacting ENT market growth are the increased air and noise pollution in the general environment.

Total Addressable Market

Defining campaign success requires understanding market penetration in relation to the total addressable market.

Like other specialties, it’s important to remember just how small the ENT community is. Layer on other campaign elements like geotargeting or ownership status, and you’re likely dealing with a relatively small total addressable market. You’ll need to utilize specialized techniques and tools to effectively market to this sized audience.

There are approximately 9,600 otolaryngologists in the US.

Traditional Demographic Information

Traditional demographic data tends to be less important in ENT advertising than in B2C marketing or even other types of B2B marketing. But demographic information can be used to make some inferences about your audience or to help tighten audience segments for smaller advertising budgets – it really depends on the product. And ENTs aren’t just doctors. They’re people too. So, it’s helpful to think about their circumstances and demographic distribution.

Age

Beyond the total addressable market for ENT advertising, you should also consider the specific product or solution you offer and who can (or cannot) buy it. Using age to make ballpark determinations on career stage, such as practice ownership, can be really helpful. This allows you to create targeted marketing for all decision contributors and can help you focus on the most valuable prospects – especially when it comes to key HCP decision-makers.

Otolaryngologists are pretty evenly split in terms of age. 49% are under the age of 55, and 51% are over the age of 55, according to the AAMC.

For example, if you’re marketing a specialized allergy shot appointment scheduling system for otolaryngologists, you’re likely going to be targeting practice owners. Unfortunately, “ENT practice owner” or “otolaryngology practice owner” is not a standard audience target in most marketing platforms. To reach this hyper-specific audience, you’ll need to use platform tools to target “ENTs” or “otolaryngologists” and then layer on various specifics around demographics to target your ideal prospects.

So, considering it takes 15 years or more to become an otolaryngologist and most docs will work for a few years to save up money before opening a private practice, it’s fair to assume that you can limit your target audience to those 35 and above. Then, consider the current economy and other healthcare market trends, and you can bump the target age range to 45 and above, especially since, compared to previous generations, Millennial med school grads were more likely to seek employment rather than opening up their own practice.

Location

It’s unlikely you’ll be narrowing down your ENT advertising campaigns to location because the resulting addressable market likely won’t meet the required minimums for most advertising platforms. However, depending on your product, you can use this information for highly specialized campaigns based on:

-

- Completion deadlines for CME requirements

- Enrollment dates for specific programs

- Prevalence of Medicare, Medicaid, or specific private payers

Similar to other specialties, ENTs tend to flock toward metro areas, creating significantly more density in these areas. In fact, 61.8% practice in a metro area with a population of over 1 million – even though this only represents 55.3% of the total population. Obviously, this maldistribution has a negative impact on rural areas, which often already have healthcare access issues. With this distribution, 65.7% of US counties do not have a single otolaryngologist in practice.

61.8% of ENTs are within a metro area, and 65.7% of US counties don’t have a single otolaryngologist in practice.

Gender

Gender is probably the least used piece of traditional demographic data in ENT advertising campaigns. However, this is a common demographic used in traditional marketing and advertising, so if you’re working with a team that has a more traditional background, this may be something they want to know.

Otolaryngologist Gender Breakdown (2021) |

||

| Gender | Number of ENTs | % of Workforce |

| Male | 7,798 | 81% |

| Female | 1,812 | 19% |

| Total | 9,610 | 100% |

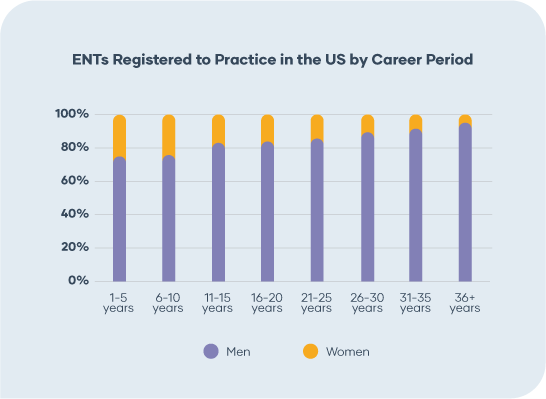

Like many medical specialties, otolaryngology is not a particularly diverse field, although there have been significant improvements over the last few decades. Back in 1963, less than 1% of ENTs were women, and that number has since jumped to nearly 20% – which is hugeprogress in just 50 years. By looking at the gender breakdown of ENTs by graduation year, a linear regression shows that this gap is closing and suggests that distribution will be equalized by the 2030s. However, when looking at other critical roles, such as otolaryngology head and neck surgery, editorial boards, department chairs, fellowship directors, and other academic positions, women are still vastly underrepresented.

There is currently a significant gender gap in the otolaryngology field; however, the increasing number of female graduates is pushing it toward an equalized male-female distribution by the 2030s.

(Source: American Journal of Otolaryngology, 2022)

Workforce Shifts

As with every physician specialty, a projected workforce shortage is coming – although it appears it won’t be as bad as in other specialties. Plus, there’s lots of contradicting information. Workforce reviews from the 1990s predicted a shortage of ENTs over the next few decades, indicating a need for 2.3-3.5 full-time otolaryngologists per 100,000 people. A more recent study from 2012, found that “with an average retirement age of 65 years and no increase in PGY-1 positions for the specialty, the number of otolaryngologists in 2025 will be approximately 2,500 short of projected demand.” However, by amalgamating numerous studies, one ENT made an interesting finding that as the industry was edging closer to time periods of predicted shortfalls, numbers were indicating that the otolaryngology supply was increasing. Ultimately, he felt the predictions were overly bleak and that workforce challenges lie in the inconsistent distribution of ENTs across geographies.

Life Circumstances

ENTs and otolaryngologists are, of course, doctors, but they are people too. Understanding their lifestyles and personal circumstances can give you some insight into how they behave and where their top concerns within their practice or profession might be.

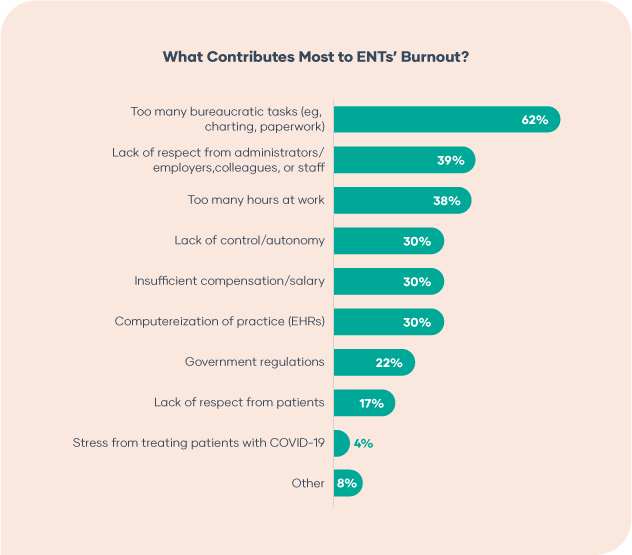

According to Medscape, the general happiness of ENTs outside of work has increased post-pandemic. Compared to other physicians, they were more likely to describe their lives as “very happy” or “happy,” but it is important to note that physicians in every specialty were substantially less happy post- than pre-pandemic. Otolaryngologists come in at the midrange when it comes to burnout compared to other specialties. They also tend to be aligned with other physicians when it comes to the tasks that contribute to burnout:

(Source: Medscape, 2023)

On average, ENTs earn $469K per year – a nearly 13% increase in the last year and the highest compared to other specialties. Overall, otolaryngologists feel fairly compensated, with fairly few perceived threats to their income compared to other specialties, who often worry about nonphysician practitioners or “minute clinics” from big-box stores.

On average, ENTs earn $469k per year.

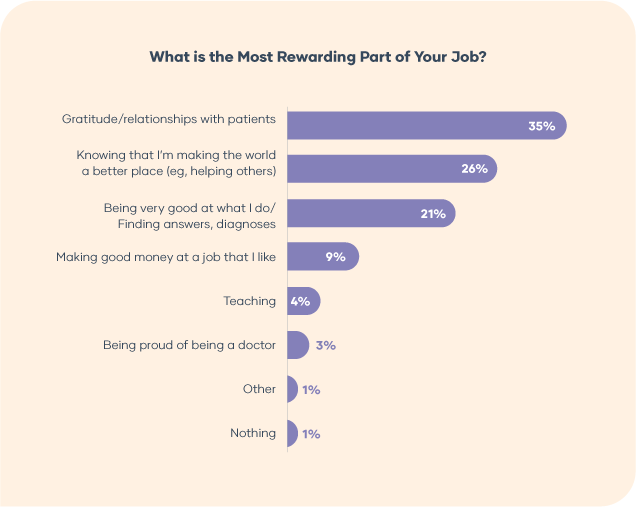

Nearly 71% of ENTs said they would still choose to enter the medical field, and 87% said they would specialize in otolaryngology again. This rate is consistent with other physicians, of whom 73% would pick medicine again. This is due to various job satisfaction aspects:

(Source: Medscape, 2022)

ENT Targeting Criteria

Layering traditional demographic data with ENT advertising specifics is the key to successful HCP marketing campaigns. It’s these nuanced details that ensure you target the right prospects without wasting precious advertising budget.

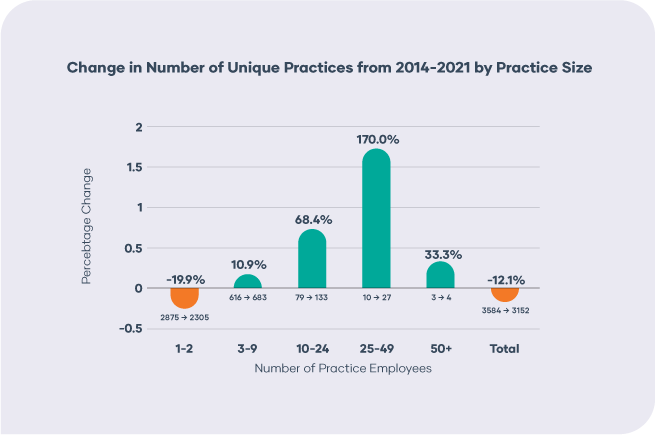

Practice Setting

Practice setting is one of the most important parts of any HCP specialty. Do the physicians spend their time in a small office, or do they work in a giant hospital? Or some combination? Like many of their specialist counterparts, otolaryngologists are experiencing significant consolidation across practices. There has been significant consolidation since 2014, with no signs of slowing; however, determining ENTs’ employment preferences is still hard to assess. By taking a look at the placement and preferences of first-year residents, it appears that many are choosing to join large academic institutions for more research and funding opportunities. While ENTs may not be making the move toward facility or integrated healthcare settings, being a part of larger practices means less direct influence over purchasing decisions and can make otolaryngologists harder to reach.

(Source: OTO Open, 2022)

Payment Models and Public Programs

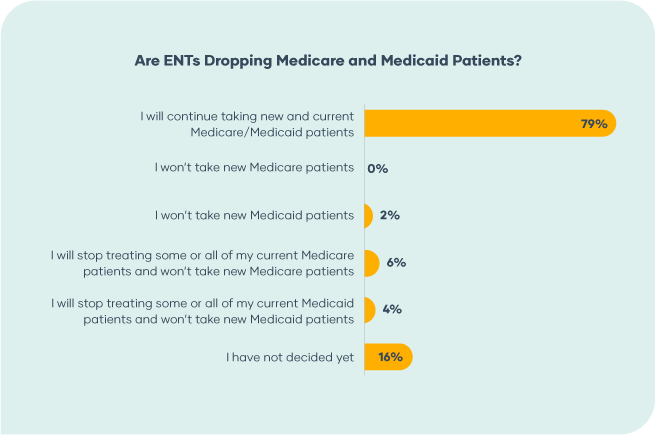

Medicaid and Medicare Acceptance

Like those in any profession, ENTs want to get paid. Most patients that are seen don’t (and often cannot afford to) pay for treatments out of pocket. The reimbursability of your product or solution could be a make-or-break component of getting the sale.

(Source: Medscape, 2023)

These trends are overall consistent with the previous year’s findings. However, throughout the healthcare industry, some physicians have decided to opt out of accepting Medicare patients due to low reimbursements, and the issue is even worse with Medicaid. Other docs have cited an increase in billing issues with Medicaid as a reason for opting out.

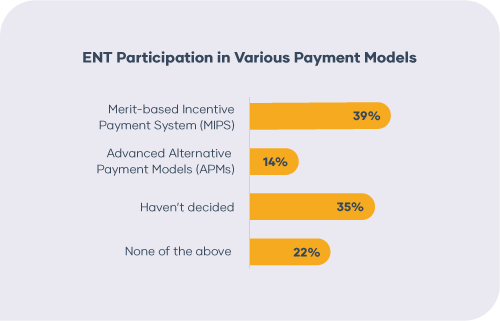

MIPS vs. APMs

Another component to consider is ENT participation in alternative payment model (APM) programs and the merit-based incentive payment system (MIPS).

(Source: Medscape, 2023)

Otolaryngologists are fairly consistent in their MIPS and APM participation, although there has been a very slight shift to more APM participation over MIPS.

According to the Healthcare Financial Management Association, an increase in APM participation is often accompanied by a dip in MIPS enrollment. This shift in program participation is continuously becoming more common across the healthcare marketplace.

Skills and Subspecialties

ENTs include a few subspecialties, including those around head and neck surgery. The key to using this data is to layer skills and subspecialties into targeting to reach even more specific prospects. At a high level, otolaryngology can be broken down into adult and pediatric specialties. Beyond those two groups, there are a handful of additional specializations:

-

- Neurotology

- Plastic surgery of the head and neck

- Sleep medicine and surgery

- Otology

- Laryngology

- Skull base surgery

- Rhinology and sinus

Beyond the MDs

Keep in mind that doctors aren’t the only people making medical recommendations and interacting with patients, which means your marketing materials shouldn’t focus only on them.

To make the strongest impact, it’s essential to address the team that surrounds the doctor every day. This includes the medical support staff and mid-levels, such as physician assistants (PAs), nurse practitioners (NPs), and registered nurses (RNs). These team members all spend considerable time with patients, have some latitude in their work, have the ear of the doctor, and are often easier to reach than an MD or DO. In the case of otolaryngology, there’s only one recognized credential be helpful in identifying ENT-specific nurses:

-

- Certified Otorhinolaryngology Nurse (CORLN)

However, that’s not to say there aren’t ENT-specific nurses; they may just operate under more generalized certifications. And while many ENTs are working within larger group practices, you can’t forget those who do still run their own practices and the teams that support them. This includes administrators and office managers who keep things running. These roles tend to have a ton of insight into finances and operations and can be a big influence in purchasing-related solutions.

Prescribing Behavior

Various demand-side platforms (DSPs) offer programmatic advertising that allows you to target doctor specialties based on their prescribing behavior or CPT history. This can be very advantageous when targeting specific subsectors of the otolaryngology discipline.

Look-Alike Audiences and Hashtags

To weed out consumers versus HCPs, look-alike audiences, and hashtags may be helpful in building out target audiences on social media. However, to build those audiences, you must take a critical look at who follows the various accounts/hashtags and the types of content they are promoting or associated with.

There are quite a few otolaryngology associations for MDs and DOs to join; these are a good place to start. In addition, we recommend building ENT advertising based on audiences engaging with the following types of accounts:

-

- Conferences

- Medical school alumni associations

- National and regional associations

- Specialty journals and publications

With hashtags, it’s important to leverage medical language to avoid targeting patients. Some examples of hashtags we use to target ENTs include:

-

- #ENTtwitter

- #ENTsurgery

- #OTOTwitter

It’s also great to use relevant meeting and conference hashtags – these tend to be some combination of year and conference acronyms, such as #2023COSM or #OTOMTG23.

Feel a bit overwhelmed with all the elements of ENT advertising?

Let us help.

ENT advertising is not easy. It requires expertise and a nuanced understanding of how to make the advertising platforms work for an audience they were not designed for. There’s a lot to consider, which is why we recommend partnering with an ENT advertising expert like glassCanopy.

We provide start-to-finish lead-generation campaigns and expert content for organizations looking to launch ENT advertising and marketing programs. We handle everything from strategy and content creation to campaign deployment and optimization.